TDS rates revised for accounting year 2019-2020

Overview

TDS or Tax Deducted at Source is the tax that is deducted at the source of income of a person. During the union budget every year, the revised rates are announced. There are a number of rates for different nature of income falling under different heads. This could vary from 1%-30%.

Aim of TDS

The main aim of TDS is to deduct the income at the very source and remit the deducted amount to the central government’s account. Furthermore, the person from whose account this amount is deducted is eligible to get a credit of such amount through Form 26AS or TDS certificate issued by the deductor.

The basis of TDS Deduction

- TDS is deducted at source before receiving income under different heads such as incentive (bonus/perks), interest earned on fixed deposit, lottery winnings, rent paid or commission payment.

- Tax is deducted, according to a rate, before the process of payment is carried out and if the tax is deducted more, then the person is eligible for TDS return. Apply now for TDS return filing

- Deductor is the person/organization/company/institution providing income. And Deductee is the person from whose account the tax is deducted.

- The employer is needed to provide form 16/16A (TDS certificate) to the employee. And there is no need for this certificate in case of TDS exemptions.

Exemption from TDS

TDS is exempted in few cases. For instance, if you make the payment to the RBI or Central government. Along with this, TDS is exempted from the interest paid to the following

- Banking companies.

- Refund on income tax.

- Direct taxes.

- LIC, UTI, and interest made in co-operative societies.

- Financial corporations formed under the finance bill of union government or any state.

- Any organization falling under Nil TDS organization.

- The interest earned on the following:

- from a savings account operated in cooperative societies or commercial bank.

- on NRE account.

- on Indira Vikas Patra, NSC or KVP.

Sections of TDS

Income Tax act 1961 describes TDS as a spot tax which is deducted from the actual source of income. It is applicable on the income received from financial products like interest received on fixed deposits, incentives from the employer, commission’s payments, dividends on bonds, sale/purchase or rent of any immovable property and money earned as lottery or awards.

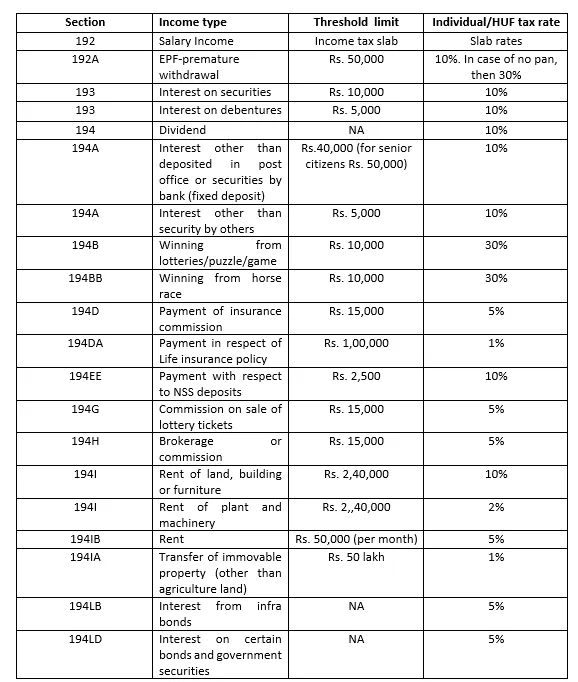

Latest TDS rate of annual year 2019-20

The rates at which TDS is charged is declared under various provisions of the Income Tax Act or the first schedule of the Finance Act. If this payment is to non resident citizens, then the provisions of withholding tax rates under Double Taxation Avoidance agreement shall also be considered.

Payment portals of income tax

Tax deducted at source is supposed to be transferred to credit of Central government account via the following ways:

Electronic mode: E-payment is necessary for

- Every corporate assesses

- All other corporate assesses other than companies, to whom the section 44AB of Income tax, 1961 is applicable

Physical mode: A person can file TDS by launching a challan 281 in the bank.

TDS charged rates on salary

Under section 192, TDS is charged on the average income from the employee’s account. If the income of the employee doesn’t exceed INR 2,50,000 then there is no TDS. But if the income exceeds this limit, then the TDS is charged 20%, if the person has no PAN card.

TDS charged on Insurance commission

The exemption limit of Insurance commission is Rs.15,000. Earlier it was Rs.20,000. The TDS % is 5 but 20% when the PAN card is not furnished. The TDS rates for other commissions include:

- Section 194G: Commission charged on sale of lotteries, which is 5%

- Section 196H: Commission charged on brokerage, which is 5%

- Section 196J: Remuneration/fee/commission charged to a director, which is 10%.

TDS charged on services

According to section 194J, a person is liable to pay the TDS in the following payments

- Service charge for technical services

- Service charge for professional services

- Remuneration/fee/commission to the director

- Royalty paid

If the person possess PAN card, he/she is supposed to pay 10% but when PAN card is not furnished, then higher rates are charged as follows

- Provisions mentioned under either the Finance Act or Income Tax Act

- TDS at the rate 20%

TDS charged on Fixed Deposits

TDS charged on fixed deposits is exempted till INR 10,000 per annum i.e. until the fixed deposit year exceeds Rs. 10,000, no TDS is charged. When this limit is exceeded, the TDS is charged at the rate 10% otherwise 20% (when there is no PAN card). For senior citizens (above 60 years old) this limit is Rs.50,000 per year.

TDS rates charged on contracts

Under section 194C, the payment made to complete the contract for the following work is charged.

- Advertisement contracts

- Telecasting or broadcasting contract

- Transport of goods from any mode (other than railways)

- Catering services

- Production or supplying goods according the specifications made by the buyer, for which the raw material is supplied by the buyer as well.

- Supplying labor for contractual work

The rate under section 194C is 1% for individual or HUF, but otherwise it is 2%. In case of absence of PAN card it is 20%.

TDS rates charged on interests

Section 194A communicates the provision of TDS charged on interest other than securities. TDS will be charged if the interest paid by bank exceeds Rs.10,000 and if the interest paid by other sources exceed Rs.5,000.

Under this section, TDS is charged at the rate of 10% (if the person has PAN card) and 20% (if he/she doesn’t)

Exemptions of section 194A:

· If the interest is paid on loan taken from bank

· If the interest is paid on loan is taken from friends and relatives

· Interest is paid on any unsecured loan.

This article is written by Anubhav, who is a content writer at LegalRaasta.

LegalRaasta is a platform that offers tons of legal services like Income tax return filing, GST return filing and many more.